Behavioral Finance – “Remain Sane When Others Like to Go Crazy.”

When Berkshire Hathaway’s Warren Buffet and Charlie Munger were asked what the greatest competitive advantage has been to their investment success, Munger responded, “We have tried to remain sane when others like to go crazy.” In other words, investor behavior has a greater impact on investment results than does the performance of investments.

Emotional EQ

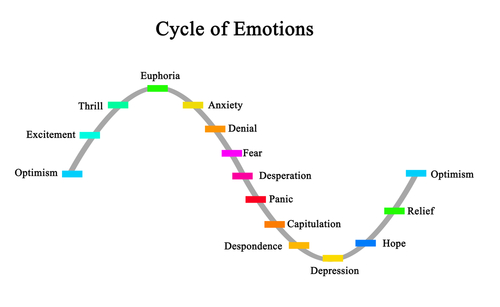

Often with help from the daily news media, it can be easy to see the marketplace as a chain of mostly threatening economic events. This induces emotionally driven tactics, with the illustration below showing the emotions most often correlated to market timing at its worst.

This emotional roller coaster causes many investors to buy and sell at inopportune times through the market’s advances and declines. Remaining focused on long–term results and out of short-term, tactical and emotionally driven reactions is vital to your investment health.

The Rational Investor

Lifetime investment success is driven by having an investment strategy that helps keep rational thought ahead of emotional reactions to the day-to-day news cycle.

- Focus on selectivity and unique business merit versus being generically invested in the market;

- As long as fundamental economic data remains constructive, do not try to time the market around short-term volatility.

- Understanding why you are invested the way you are and how it serves your overall financial goals is empowering and works to defend against media-triggered emotions about the market.

Summary

Confidence flows from strategy, and a commitment to rational investing provides for a sustainable investment advantage.