October 2018:

When the market goes volatile and choppy, we all get concerned. It is important to us to keep you informed on our take amidst this chop. In our view this is not the beginning of “end.” (The end of the economic expansion, the end of the bull market, the end of opportunity.)

From our perspective, October has seen two distinct phenomena unfold simultaneously. The first is a plain vanilla, short-term panic about whether the good things that accompany further economic growth can be expected to continue. Pockets of volatility around this same theme have recurred since the beginning of this expansion back in 2009. Over this period there have been six volatility pockets with declines greater than 10%, and four more with declines ranging from -5% to -10%. Despite these intermittent setbacks, the market has returned more than 200% cycle-to-date.

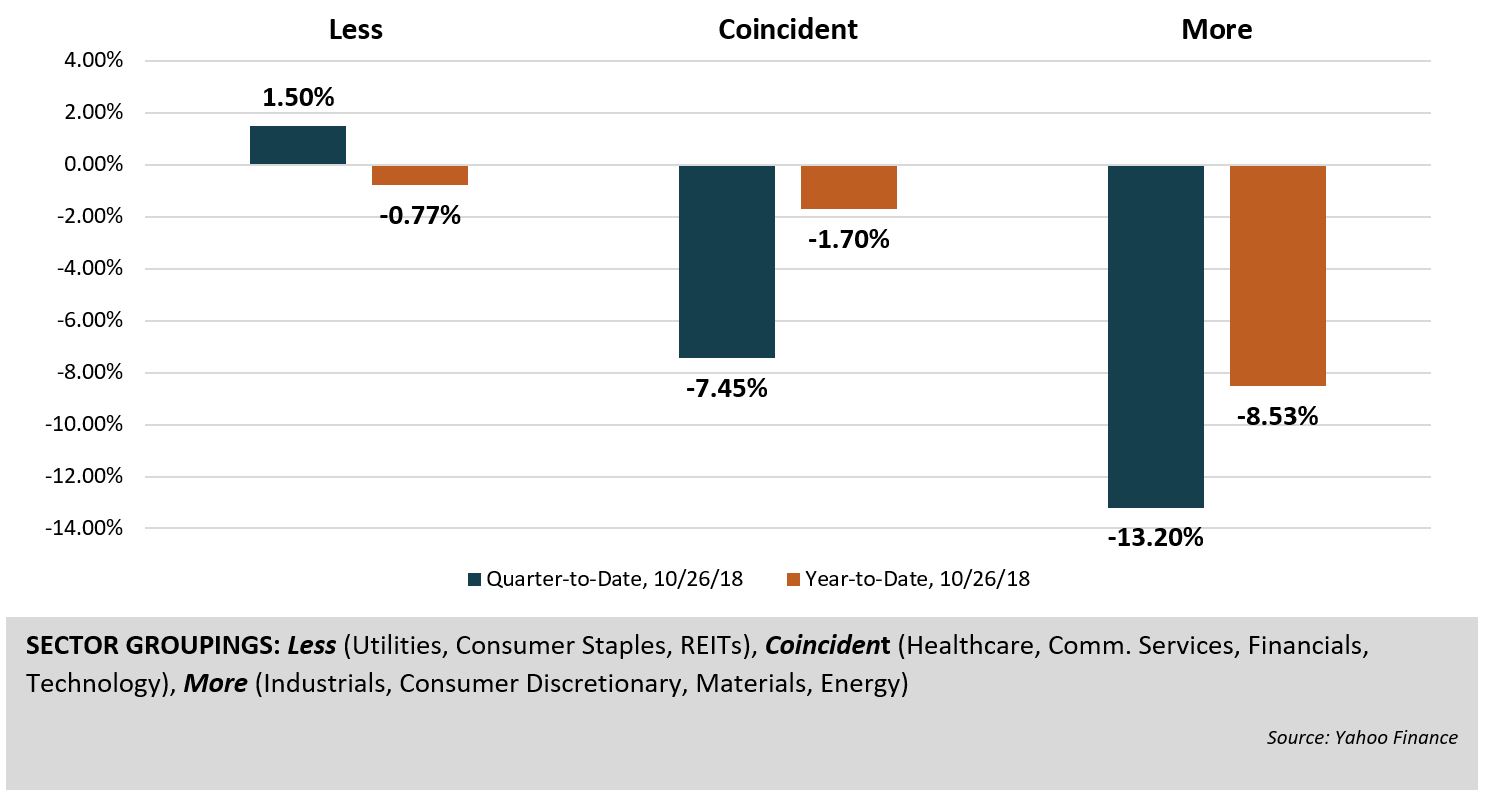

The chart below illustrates that during October’s decline, less economically sensitive sectors have declined less, and more economically sensitive sectors have declined more – a classic illustration of anxiety-related volatility. Periodic turbulence is normal; the line wiggles along the upward trend during economic expansions. The second element is a valuation correction within the segment of the market that represents the most expensive stocks. At the end of the third quarter, a handful of companies (just 13) in the S&P 500 Index (representing about 7% of the Index market cap) traded at expensive and rarefied valuations (average PE multiple of nearly 90 times earnings). Though few in number, these companies were disproportionately influential (think Amazon and Netflix) in impacting Index returns, this small group had returned 54.8% year to date through the first three quarters. These companies are part of what we refer to as a “bubble under construction.”

S&P 500 Index Sector Performance Year-to-Date 10/26/2018

Classic Correlation to Economic Sensitivity: Less, Coincident and More

Since the end of the quarter, the market has declined nearly 8%, while these more expensive companies are down an average of 16% in the same period. It does not surprise us when premium priced stocks correct for valuation. Assuming the economic expansion continues and earnings rise, solid companies that are fairly priced can continue to offer attractive risk adjusted returns, even when glamour stocks behaving less than glamorously.

In thinking critically about the market in October, the data supports that:

- this is mostly a sentiment and momentum driven moment (versus data driven) with the larger impact affecting the most economically sensitive sectors;

- it is a valuation correction in which the most expensive stocks have pulled back the most, and we can report that our investment discipline has steered us away from the “bubble under construction”;

- the economic expansion continues apace; and

- constructive gains in earnings have been reported to date for the third quarter of 2018 and are also forecasted for the year ahead.

In our view, the current volatility does not signal the end of this economic expansion, which will likely be the longest in the history of the U.S. economy. Today’s GDP report certainly showed healthy growth in the 3rd quarter. Rather, this has been a fairly typical volatility pocket in an expansionary market, and despite the detour, opportunities continue for U.S. equity investors.

There will be a time to shift to a more defensive posture, but our take is that we are not there yet. We are maintaining our existing strategy and allocations. None of the ten previous volatility pockets were agreeable events, and yet from today’s vantage point hardly any of them are memorable. We believe that continued focus on opportunity will create a memorable outcome.

All market data sourced by Capital IQ