November 2018:

We are going to say something in Tealwood terms: this is not the second inflection point.

Now, for the translation. At Tealwood, we are proud to speak our own private, internal language. Terms that sound vague to others are full of potent meaning to us. “Private Investment Counsel” can send us off on a long, passionate riff; “Alignment” can spark spontaneous declarations about purpose; and “Rational Investor” carries a cult-like significance in our world. Today, we want to share a message about “S4C.”

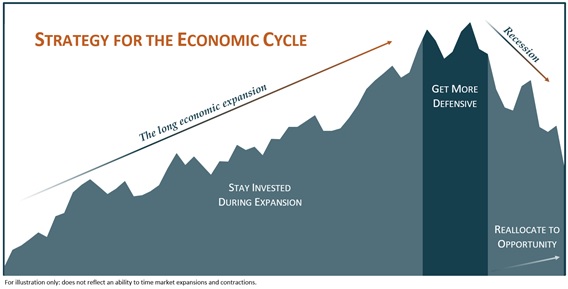

S4C is an abbreviation for Strategy for the Cycle. The strategy is to integrate insights regarding the correlation between the economic cycle and the marketplace. To oversimplify for the sake of brevity, when the economy is in expansion mode, our equity markets expand; and when the economy contracts, our equity markets contract. We do not believe there are Bull Markets or Bear Markets as phenomena independent of the cycle. Bull Markets take place in expansions and Bear Markets take place in contractions. We do not regard the 5% and 10% bumps in the road that happen along the way in expansions to be the disruption. Instead, we see the cyclical risk of the average 32% decline that happens in recessions to be the disruption deserving of risk management. Over the last 60 years, there have been six declines of 25% or more and five of them occurred in recessions.[/vc_column_text]

We see the October sell-off as an “ordinary” volatility pocket, one of those bumps in the road (the 11th since 2009). Outside of the Technology and Energy Sectors, November has been mostly unremarkable. Technology and its corollaries have been going through a necessary valuation correction and the Energy Sector went through its own regular commodity-price-induced volatility. The rest of the marketplace is mainly healthy and reasonably priced. We see more expansion into 2019 and expect to find ongoing rewards in the expansion. While we continue in expansion mode, we are alert to the risks that attend the second inflection point and will be loud and clear in communicating the shift in strategy that risk management requires.

Congratulations, you now speak Tealwood.