The DFI portfolio has an average maturity of 1.7 years and an average yield to yield to maturity of 3.3%. As a peer, the Barclays 1-3 Year Credit Index has an average maturity of 2.9 years and a yield-to-maturity of 2.6%.

As a reading on just how flat the yield curve is currently, the Barclays Aggregate Index, with an average maturity of 7.9 years, has a current yield of 2.5% and a yield to maturity of 2.5%. In this interest rate environment, investors get little reward for extending maturities and the incremental risk of longer duration investing.

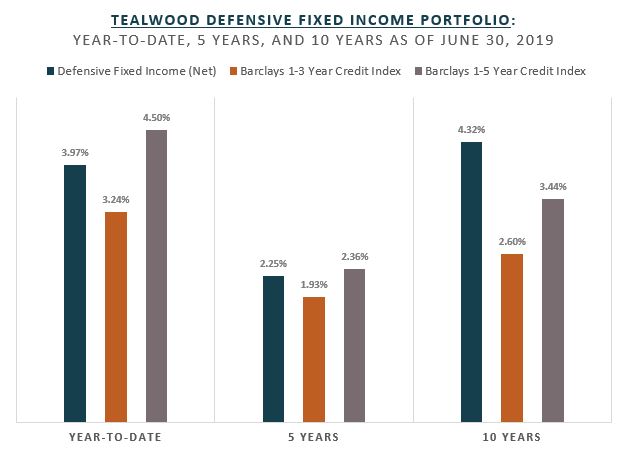

The ten-year track record was accomplished while managing for both credit and duration. Our investment strategy has made the difference and we look forward to the ongoing implementation of this distinct approach. We are gratified to have fulfilled our mandate and delivered value-added results over this decade.

*All performance and data from Orion as of 6/30/2019. Performance returns greater than one year are annualized. Past performance does not guarantee future results. The returns shown are net of all fees and commissions. Income for Tealwood accounts are included in returns. The indices are materially different from our actual portfolios and may have more or less volatility. The indices do not incur management fees, cost and expenses. An investor cannot invest directly in an index.