Complacency Lost

As we write this, the S&P 500 Index posted a decline for the month of September and has gotten off to a rocky start in October. This reality check has shaken complacent investors and it has our attention. It seems most investors have become spoiled by a well-behaved market that has delivered outsized returns and the narrative struggles to explain how this, once again, became a two-way street. Expectations have evolved to anticipate perfection from the market, but the world is not cooperating and offers plenty of imperfections in return.

Regression to the Mean

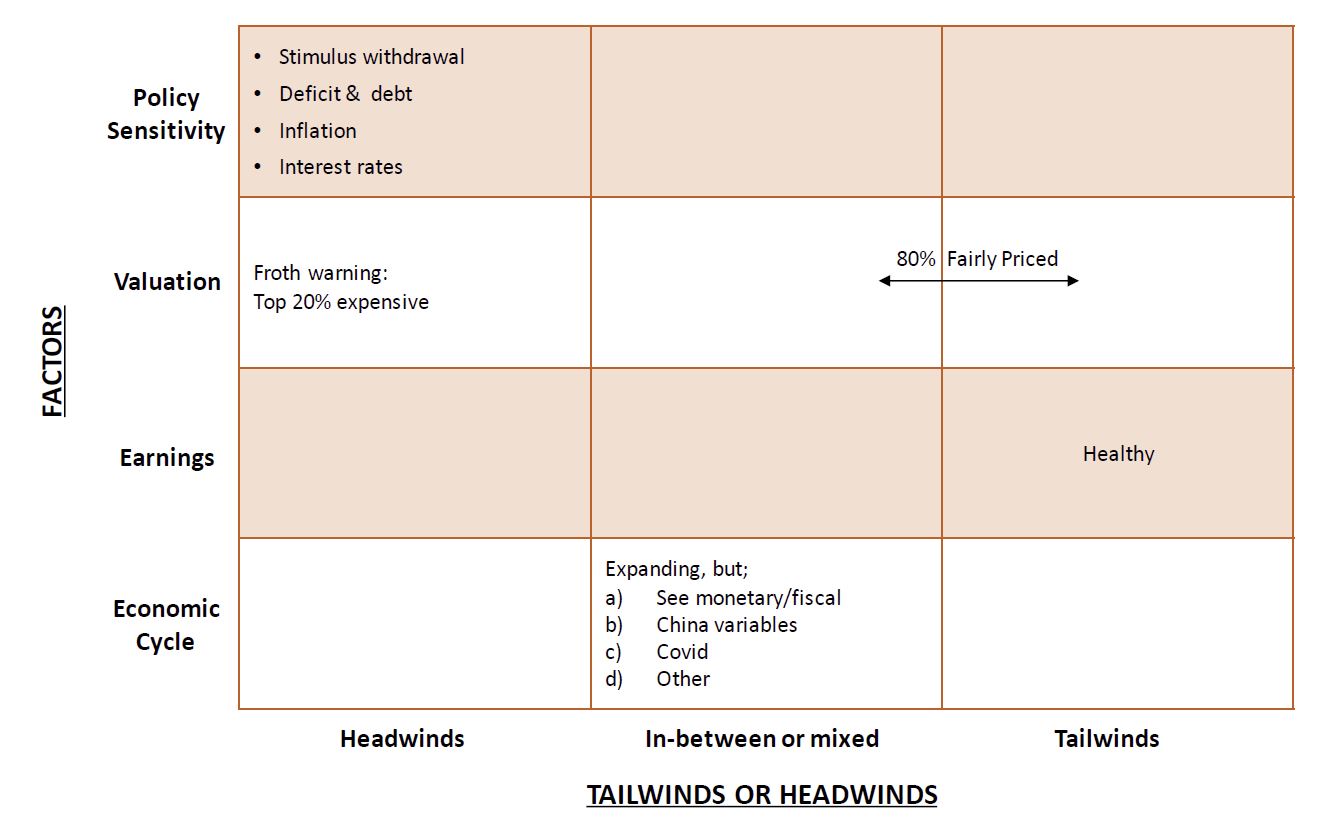

For our part, we have been expecting an environment that looks like two steps forward and one step back. Simultaneously we are likely to have favorable news regarding the economy and earnings, and complicated news regarding valuations. We face the prospects of going through an unprecedented wind-down of fiscal and monetary stimulus. For almost three years valuations have been expanding much quicker than earnings (in round numbers for 2019-2021, earnings were up approximately 24% and the S&P 500 Index up approximately 69%*). It is unsustainable for valuations to rise quicker than earnings in perpetuity. We do not forecast a bear market, but we do anticipate a several year period of constructive, more modest results and the prospect of rising interest rates likely to bring about a valuation correction – particularly in the most expensive companies.

This would make for a stark contrast to the past three years in which higher risks delivered higher rewards. Regression to the mean or “getting back to average,” will have higher risk. So how does one most effectively capture the constructive and manage the risks?

Strategy for a More Sober Marketplace

First, the most effective focus is on owning quality businesses that operate with a competitive advantage. Bottom-up fundamental merit and business quality most often prevail through top-down headwinds. Second, having a valuation discipline will be relevant again and investing at fair prices will contribute to a competitive advantage. We are confident that our “Quality at a Reasonable Price” investment discipline will navigate the challenges ahead. We are not talking about a period in which business will be bad, rather a period in which the market will show more signs of stress.

Year-to-date, our fixed income strategies have performed relatively well, generating positive returns in a bond market full of many declining indices. Our strategic emphasis on shorter maturities and comparatively better credits has served well. Given our general, broader view that interest rates will likely rise in this period, we believe our defensive approach will continue to provide for advantages.

Personal Needs and Goals are THE Priority

Revisit your asset allocation with your advisor and be sure that your allocation is personally fit for you. Manage your expectations. Historically, three-year periods that average 20% per year have not been sustainable (just three episodes since the Great Depression, including this one**). Focus on quality and reasonable price and expect to make the most out of a ride that will include some turbulence.

*Data sourced from FactSet as of 10/4/2021

**Source: Jason Hall, The Motley Fool, 09/03/2021: https://www.fool.com/investing/how-to-invest/stocks/average-stock-market-return/